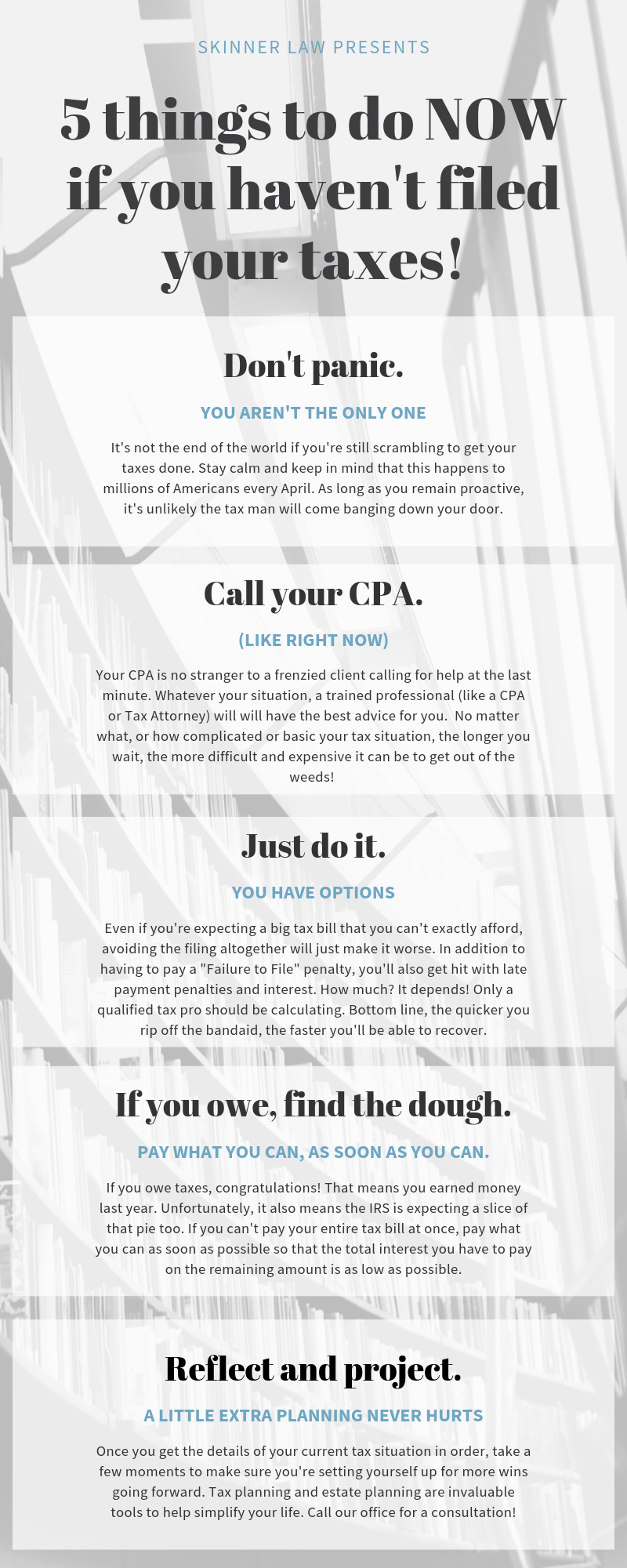

It’s not the end of the world if you’re still scrambling to get your taxes done. Stay calm and keep in mind that this happens to millions of Americans every April. As long as you remain proactive, it’s unlikely the tax man will come banging down your door. Follow the steps in the infographic below to resolve the situation quickly!

Your CPA is no stranger to a frenzied client calling for help at the last minute. Whatever your situation, a trained professional (like a CPA or Tax Attorney) will have the best advice for you. No matter what, or how complicated or basic your tax situation, the longer you wait, the more difficult and expensive it can be to get out of the weeds!

Even if you’re expecting a big tax bill that you can’t exactly afford, avoiding the filing altogether will just make it worse. In addition to having to pay a “Failure to File” penalty, you’ll also get hit with late payment penalties and interest. How much? It depends! Only a qualified tax pro should be calculating. Bottom line, the quicker you rip off the band-aid, the faster you’ll be able to recover.

If you owe taxes, congratulations! That means you earned money last year. Unfortunately, it also means the IRS is expecting a slice of that pie too. If you can’t pay your entire tax bill at once, pay what you can as soon as possible so that the total interest you have to pay on the remaining amount is as low as possible.

Once you get the details of your current tax situation in order, take a few moments to make sure you’re setting yourself up for more wins going forward. Tax planning and estate planning are invaluable tools to help simplify your life. Contact our office for a consultation!